20+ Calculate The Covariance Between Profits And Market Capitalization

BRING DATA IN TO EXCEL SHEET 2. The relationship between profits and market capitalization indicates that they are strong.

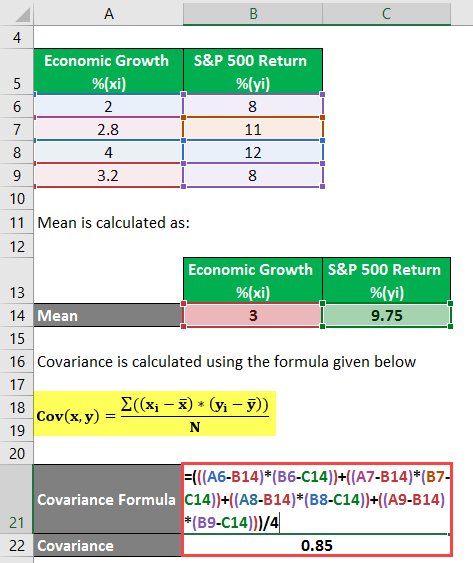

Covariance Formula Examples How To Calculate Correlation

Three decimal places b calculate the correlation between.

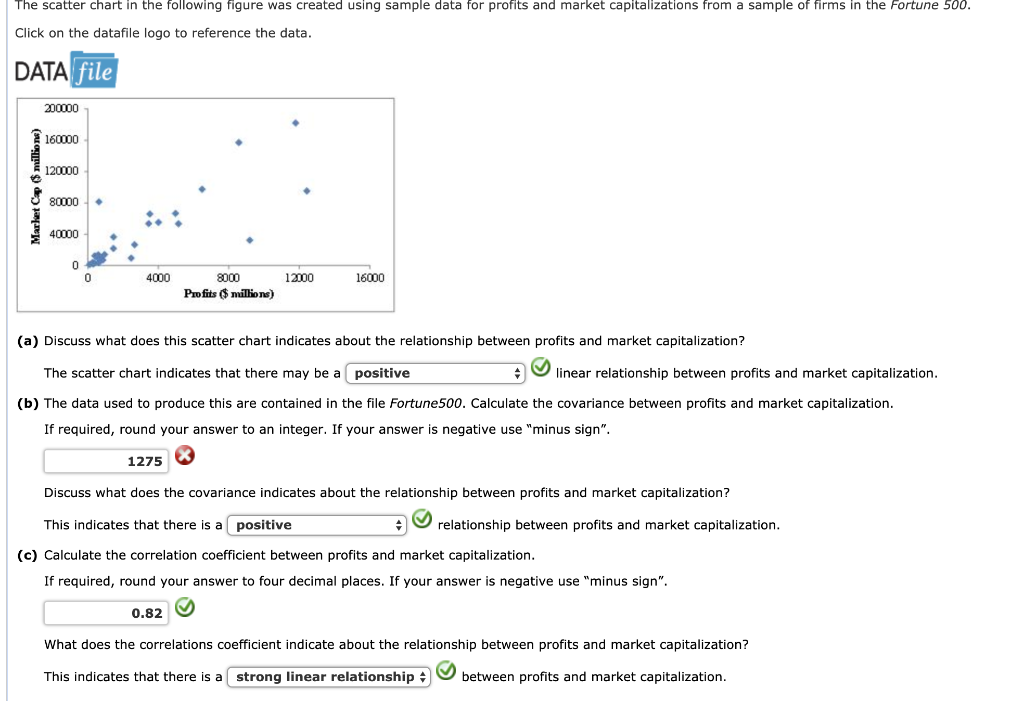

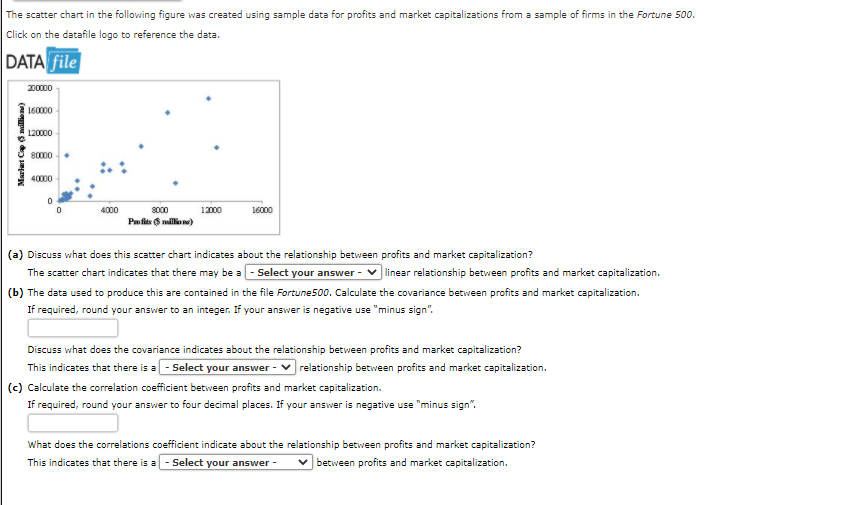

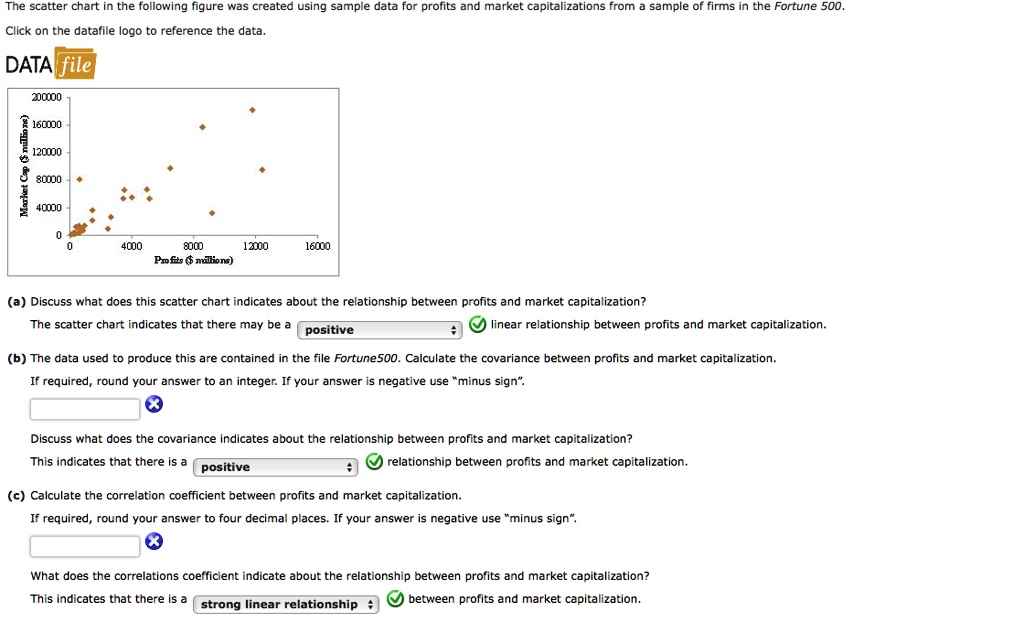

. 1 a calculate the covariance between profits and market capitalization. Because the market capitalization rises as profits rise for most of the plotpoints in the graph there is a slightly positive linear relationship between profits and market capitalization. BRING DATA IN TO EXCEL SHEET 2.

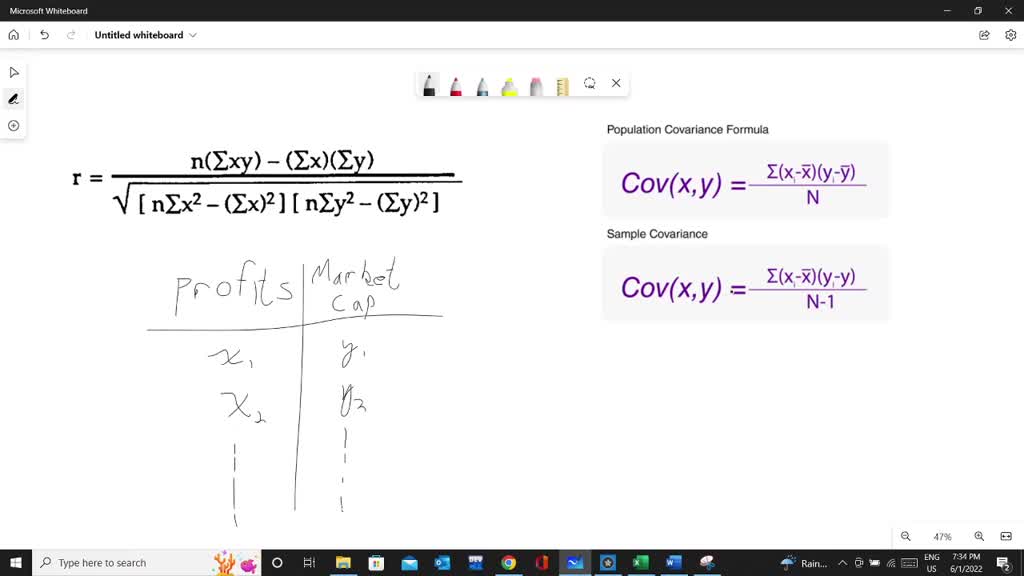

Covariance is usually measured by analyzing standard deviations from the expected return or we can obtain by multiplying the correlation between the two variables by the standard deviation. WRITE A FORMULA COVAR ARRAY1ARRAY2 AND GET THE COVRIANCE BETWEEN TWO VARIABLES 3. Covariance is a measure of the relationship between two or more variables.

In finance it is used to measure the relationship. 100 2 ratings COVARIANCE. 1 Answer to Calculate the covariance between profits and market capitalization and what does the covariance indicate about the relationship between profits and market.

Up to 3 cash back Calculate the covariance between profits and market capitalization. So you seem to have everything completed besides the co variance calculation and the correlation coefficient calculation And it says that al. BThe data used to produce this are contained in the file Fortune500.

This problem has been solved. View the full answer. WRITE A FORMULA COVAR ARRAY1ARRAY2 AND GET THE COVRIANCE BETWEEN TWO V.

The scatter chart in the following figure was created using sample data for profits and market capitalizations from sample of firms in the Fortune 500 Click on the datafile logo to reference. Covariance is closely related to correlation. The scatter chart indicates that there may be a _____ linear relationship between profits and market capitalization.

The scatter chart indicates that there may be a positive linear relationship between profits and market capitalization. B The data used to produce this are contained in the file. Calculate the covariance between profits and market capitalization and what does the covariance indicate about the relationship between profits and market capitalization.

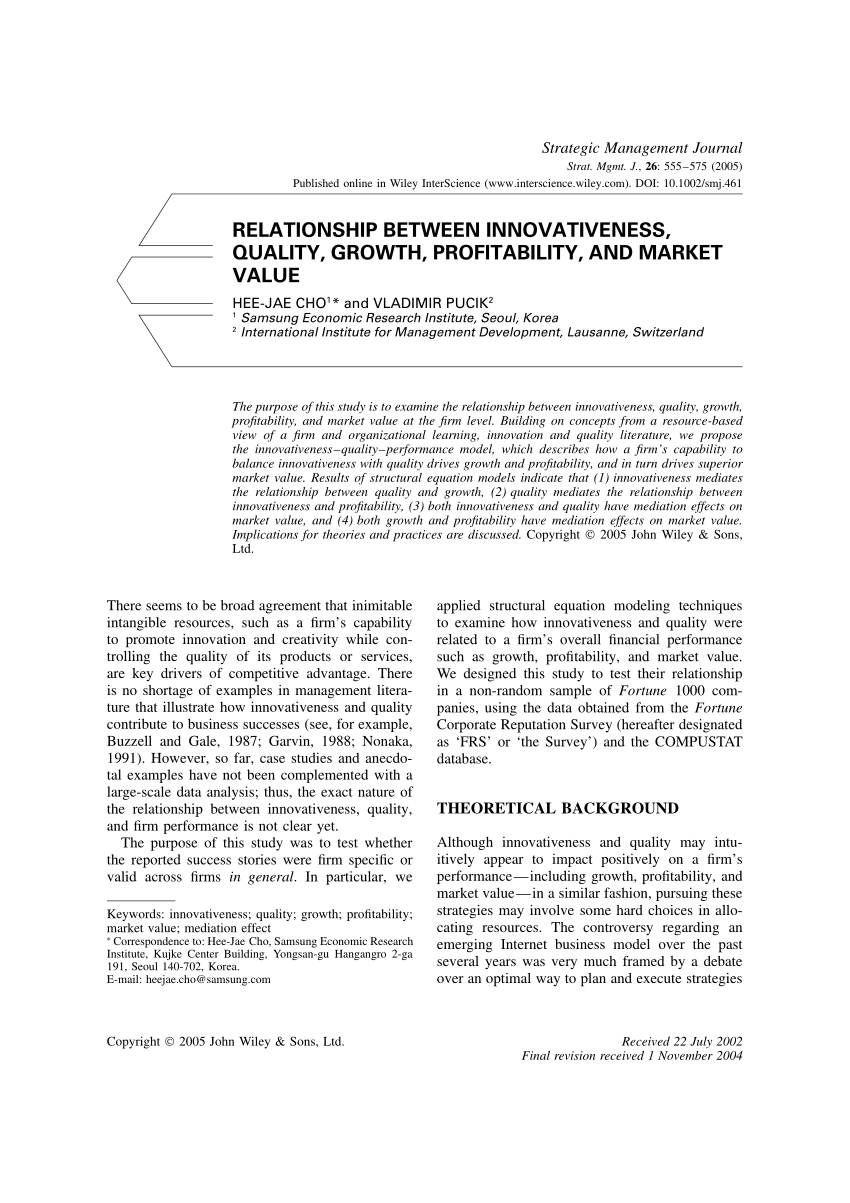

Pdf Relationship Between Innovativeness Quality Growth Profitability And Market Value

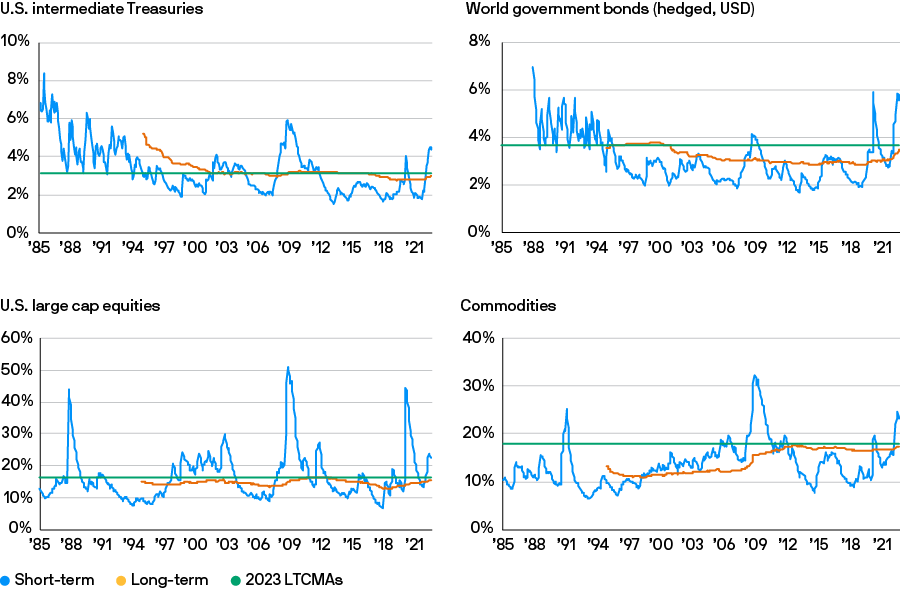

Long Term Capital Market Assumptions J P Morgan Asset Management

Fmqurmqlgxwuum

Pdf Measuring Firm Size In Empirical Corporate Finance

Log And Log Return Time Series Of The National Stock Market Indices Download Scientific Diagram

Variance Covariance Matrix Of Cash Flow And Discount Rate News Download Table

Solved The Scatter Chart In The Following Figure Was Created Using Sample Course Hero

Solved The Scatter Chart In The Following Figure Was Created Using Sample Data For Profits And Market Capitalizations From Sample Of Firms In The Fortune 500 Click On The Datafile Logo To

The Scatter Chart In The Following Figure Was Created Chegg Com

Finc2012 Corporate Finance Ii Notes Finc2012 Corporate Finance Ii Usyd Thinkswap

Solved The Scatter Chart In The Following Figure Was Created Using Sample Course Hero

Solved The Scatter Chart In The Following Figure Was Created Chegg Com

Solved The Scatter Chart In The Following Figure Was Created Using Sample Data For Profits And Market Capitalizations From Sample Of Firms In The Fortune 500 Click On The Datafile Logo To

Solved The Scatter Chart In The Following Figure Was Created Using Sample Data For Profits And Market Capitalizations From Sample Of Firms The Fortune 500 Click On The Datafile Og0 To Reference

Gs 424b2 Htm

Pdf Mba H4010 Security Analysis And Portfolio Management Saptarshi Roy Academia Edu

Calculating And Using Covariance And Linear Correlation Coefficient 365 Data Science